Apr 1, 2022 3:31:12 PM

Weekly Market Wrap 01/04/2022

There is fresh hope for Peace talks as Russia and Ukraine are set to resume negotiations. The UK’s cost of living crisis continues as pressure on households looks set to increase whilst Europe is also suffering from price increases as record high inflation levels were seen in March. Vladimir Putin makes a threat to buyers of Russian gas, however gas is currently still flowing to European nations. The US is set to tackle rising prices by rapidly increasing releases from its oil reserves. US jobs data gives markets a first look at how the US economy is handling the current volatile environment.

US Markets

The S&P 500 ended the week flat whilst the Dow fell 0.23% to 34,754. On Friday, US jobs data showed unemployment is currently at a post-pandemic low at 3.6% and nonfarm payrolls data showed that 431,000 jobs were added in March. The data showed that the US economy is still making solid progress despite the challenges of war, inflation and supply chain issues. President Biden announced the largest ever release of US oil reserves on Thursday and called on oil companies to help American families suffering from increased prices. The US is also speeding up progress in two major liquified natural gas projects due to anticipated demand as Europe seeks to reduce its dependency on Russian oil.

UK Market

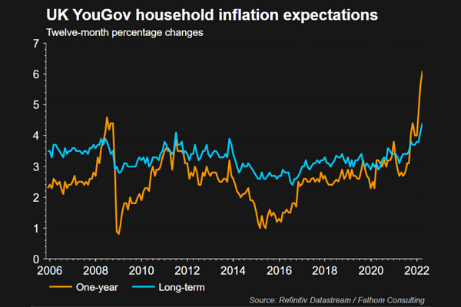

The FTSE 100 gained to reach 0.88% at 7,549. Defensive stocks made slight gains on Friday morning as the index struggled for direction this week. UK households are currently bracing for even higher levels of inflation than those seen in the aftermath of the 2008 financial crisis. Data released on Friday from the British Chamber of Commerce showed that almost two thirds of businesses in the UK expect to increase their prices in the next three months. This news comes on the same day that UK household energy bills are set to increase by more than 50%, deepening further the cost of living crisis that the UK is battling.

European Markets

The Euro Stoxx 50 ended the week up 1.58% at 3,928, the DAX rose 1.18% to 14,473 and the CAC 40 gained 2.20%, ending the week at 6,698. News of renewed peace talks between Russia and Ukraine gave stocks a small boost on Friday. However, Eurozone inflation reached a record high of 7.5% in March, piling pressure on the European Central Bank to take action against inflation. Russian President Vladimir Putin set a deadline of April 1st for all Russian gas purchased by foreign buyers to be paid for in roubles. Europe currently buys roughly 40% of its gas from Russia, however major European nations have rejected the move which could leave Europe desperately searching for alternative sources if Russia follow through. As of Friday morning, Russian gas was still being delivered to Europe.

Fixed Income

The US 10-Year Treasury yield has fallen by 0.16% to 2.32% this week as a drop in oil prices helped to ease some investor inflation fears. On Thursday the US 2-year and 10-year Treasury yields briefly inverted, an inversion in the yield curve is traditionally a strong indicator of an impending recession for the US economy.

Commodities

Brent Crude lost 13.01% this week, falling to $104 after announcements that the US plans to begin releasing 1 million barrels of oil per day for six months in an attempt to lower fuel costs and tackle rising inflation.

Gold prices fell 0.40% to $1,930. Peace talks between Russia and Ukraine are set to resume in the coming days, calming investor sentiment. Continued rising yields on US treasuries are also putting pressure on gold as a non-income yielding asset.

The Week Ahead

Monday – BOE Governor Speech

Tuesday – RBA Interest Rate Decision

Wednesday – FOMC Minutes

Thursday – Eurozone Retail Sales; US Initial Jobless Claims

Friday – Japan Consumer Confidence

*Price changes as of last week’s close unless stated otherwise.