Apr 8, 2022 3:35:29 PM

Weekly Market Wrap 08/04/2022

The UN reported on Friday that world food prices rose c.13% to a record high in March as the war caused prices for staple grains and edible oils to skyrocket as Russia and Ukraine are major exporters of wheat, corn, barley, and sunflower oil.

Russia looks to be regrouping forces after withdrawing from the capital Kyiv’s outskirts for a new attempt to gain full control of the eastern regions of Donetsk and Luhansk. Kremlin spokesperson Dmitry Peskov confirmed “We have significant losses of troops” amid rising reports of atrocities carried out by Russian forces.

April has started in a volatile fashion as focus remains on Fed policy and how aggressive tightening will be. As early recessionary signs appear in the US yield curve, economists are assessing if and when economic growth will fall.

China’s zero-covid strategy faced serious headwinds as Shanghai announced a record 21,000 new COVID cases on Friday and a third day of testing as a strict lockdown continued and other Chinese cities tightened curbs – even in regions with no recent infections.

US Markets

The S&P 500 ended the week down 1.48% at 4479 with the tech heavy NASDAQ falling by 3.37% to 14,361.

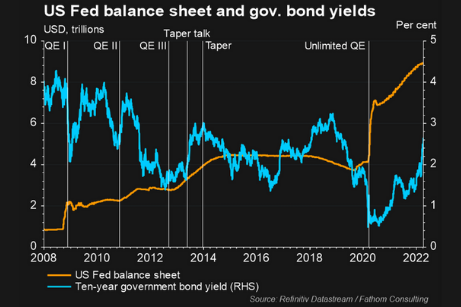

US Markets were volatile this week amid concerns around aggressive moves by the Federal Reserve to tackle inflation over the ongoing Ukraine conflict. Markets are concerned that a move from loose policy to rapid interest hikes could presage an economic slowdown.

UK Market

The FTSE 100 gained 1.24% to reach 7,631. YouGov research indicated that confidence for household finances is at the lowest level since measurement began 10 years ago as the cost-of-living crisis bites. Despite this, the Halifax House Price Index reported another increase in house prices taking the annual rate of growth to 11%.

Airports and airlines struggled as passenger numbers gradually returned to pre-pandemic levels. However, industry leaders warned the situation isn’t set to improve in the near future.

European Markets

The Euro Stoxx 50 ended the week down 2.17% at 3,834, the DAX fell 1.70% to 14,200 and the CAC 40 fell 2.64%, ending the week at 6,507.

The European Union adopted its fifth package of sanctions against Russia since the invasion of Ukraine. The UN has suspended Russia’s membership of the Human Rights Council.

Euro volatility gauges jumped as markets were confronted with the possibility of far-right French candidate Marine Le Pen winning the French presidential elections later this month, French stock volatility increased and the spread between French bonds and their German equivalents widened significantly.

Fixed Income

The US 10-Year Treasury yield continued its rise as treasuries continue to be sold off in light of the Fed’s hawkish position. Across the week yields rose by 12.52% to 2.69%, after closing last week at 2.32%.

Commodities

Brent Crude lost 3.43% this week, falling to $101. The International Energy Agency has detailed members’ contributions to a 120-million-barrel release of crude and oil products from stockpiles across the next six months announced in order to cool prices.

Gold prices rose 1.17% to $1,947. Gold prices were relatively subdued as inflationary pressures were offset by the Federal Reserve’s increasingly hawkish position.

The Week Ahead

Monday – UK GDP

Tuesday – UK Employment, EU CPI, US CPI

Wednesday – UK CPI

Thursday – ECB Interest Rate Decision, US Retail Sales

Friday – Good Friday

*Price changes as of last week’s close unless stated otherwise.