Jul 22, 2022 2:43:23 PM

Weekly Market Wrap 22/07/2022

The European Central Bank has finally taken action to curb record high levels of inflation with a 50 bp rate hike on Thursday, the first time that the ECB had raised rates for more than 10 years. The Federal Reserve will announce its policy decision next Wednesday, with a 75 bp hike expected. Italy will hold a snap election on September 25th after Prime Minister Draghi formally resigned after the coalition government failed to back the leader in a confidence vote. Meanwhile, the UK’s political uncertainty nears a conclusion as only two candidates remain to become the new prime minister, with the new leader required to tackle 40-year high inflation in the UK. Earnings season is well underway, with a number of large banks and technology companies giving gloomy macroeconomic outlooks; with inflation, higher rates and supply chain concerns dampening future business prospects.

US Markets

The S&P 500 is currently ending the week up 3.51 at 3,998 and the NASDAQ is up 5.30% at 12,059. The Fed is widely expected to deliver a 75 bp rate hike next week, after last week’s inflation data that showed an annual increase of 9.1% sparking discussion about the potential for a 100 bp hike. US Initial jobless claims rose for a third consecutive week, hinting that the US economy may be starting to slow down. Investors will look to the Fed meeting minutes for guidance on future interest rate moves.

UK Market

The UK market ended the week higher. UK Inflation hit a 40-year high this week, with CPI rising 9.4% annually in June, just ahead of economists’ expectations of a 9.3% increase. This figure has increased the possibility of a 50 bp rate hike at the Bank of England’s August meeting with BoE governor Andrew Bailey confirming that a 50 bp move is “on the table”. UK retail sales fell in June, however spending dropped by just 0.1%, rather than the 0.3% estimate. Despite a more positive number than expected, the recession risk for the UK remains high. The UK’s next Prime Minister will be either former Chancellor Rishi Sunak or former Foreign Secretary Liz Truss. Conservative MPs continued voting this week and have now reduced the remaining candidates to just two. Truss currently seen as the favourite to win the party members vote and is expected to favor tax cuts and regulation of the economy if elected.

European Markets

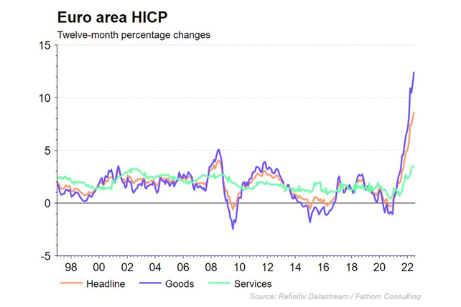

The Euro Stoxx 50 rose 4.05% to 3,618, the DAX was up 3.70% at 13,340 whilst the CAC 40 was up 3.36% to 6,237. The European Central Bank surprised investors on Thursday, breaking its own guidance of a 25 bp hike and raising rates by 50 bps. ECB President Christine Lagarde told investors that “we expect inflation to remain undesirably high for some time” and added that further increases would be made as appropriate. Despite this move being viewed by markets as a welcome surprise, the ECB is still well behind other major central banks in terms of rate hikes, with the lack of monetary policy action seen in recent months and the repeated line that recent inflation is transitory turning a number of investors away from Europe. Business activity has declined in the eurozone, with a July PMI reading showing a fall to 49.4 (any reading below 50 indicates a contraction) from 52 in June. Service sector data also fell as consumer spending reduced, hinting at lower confidence levels.

Russia cut its interest rate by 1.5% to 8% on Friday and stated that it will consider further reductions in the second half of 2022, as inflation in Russia slows and a recession looms, accelerated by the vast number of western sanctions imposed on Russia.

Fixed Income

Yields on the US 10-Year Treasury fell to 2.83%, as rising jobless claims gave a small bit of hope that the pace of rate increases could slow.

Commodities

Brent Crude rose by 1.2% this week to $102 per barrel, however prices slipped on Friday and recession fears reduced the demand forecast for oil and the resumption of oil output from Libya stunted any concerns about a lack of supply.

The Week Ahead

Monday – BoJ Policy Meeting Minutes

Tuesday – US Consumer Confidence

Wednesday – Fed Interest Rate Decision

Thursday – US GDP

Friday – EU GDP

*Price changes as of last week’s close unless stated otherwise.