Jul 29, 2022 2:20:45 PM

Weekly Market Wrap 29/07/2022

Global equity markets are set to record their best monthly returns since 2020, earnings season has reassured investors that companies globally will be able to survive high levels of inflation and a potential economic slowdown without results taking a significant hit. The Federal Reserve delivered a 75 basis point interest rate hike as markets expected, however acknowledged that higher rates may be starting to have their desired effect. The Euro zone reported two key data points on Friday, with inflation for July ahead of expectations and economic growth showing a QoQ increase; a slowdown had been forecast.

US Markets

The S&P 500 is currently ending the week up 2.80% at 4,072 and the NASDAQ is up 2.78% at 12,162. Several key US tech companies, including Microsoft, Apple, Amazon, and Alphabet reported positive results and optimistic outlooks for the businesses, despite the potential recession that may lie ahead. The Federal Reserve delivered a 75 basis point rate hike as investors had priced in, however Fed Chairman Jerome Powell hinted to investors that the pace of hiking could slow down in the coming months, noting that some economic indicators had, mainly consumer spending and production had begun to slow, meaning that higher interest rates could be starting to have an impact on the US economy. However, Chairman Powell also stated that “another unusually large increase could be appropriate” but any future moves would be contingent on further data points.

UK Market

The UK market ended the week higher. A number of UK stocks reported upbeat earnings this week; financial stocks were boosted as rising interest rates increased profit opportunities for UK lenders. Next Thursday the Bank of England will announce its latest interest rate move, with economists marginally polling in favour of a 25 bp increase, however there is a very real possibility that a 50 bp hike could occur, as the UK looks to tackle 40 year high inflation. A potential hawkish surprise would replicate the move seen by the ECB, who broke their own guidance by raising rates by 50bp, instead of the expected 25.

European Markets

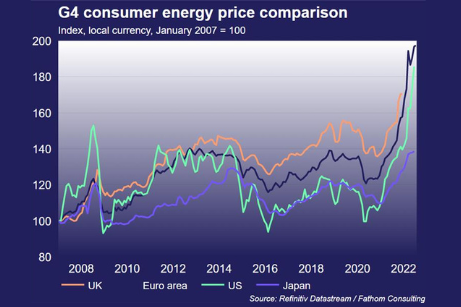

The Euro Stoxx 50 rose 2.96% to 3,702, the DAX was up 1.38% at 13,437 whilst the CAC 40 was up 3.69% to 6,445. The Euro zone economic data provided two upside surprises on Friday, firstly with inflation for July coming in at 8.9%, significantly above estimates of 8.6%. Rising energy prices were the largest contributor to the higher inflation measure and this data will push the ECB to build on last week’s 50 bp rate hike and continue to increase rates in order to calm inflation. Despite higher inflation, Euro zone GDP grew by 0.7% in Q2 of 2022, whilst estimates predicted growth of just 0.2%. Germany reported lower than expected GDP, whilst France, Italy and Spain contributed to the estimate beat.

Fixed Income

Yields on the US 10-Year Treasury fell to 2.68%, as rate hiking expectations fell after Jerome Powell’s comments acknowledging that there were signs of the US economy beginning to slow.

Commodities

Brent Crude gained 6.03% this week to $109 per barrel, as investors look ahead to next week’s OPEC+ meeting where it expected that production supply will not be increased, keeping oil demand strong.

Oil companies ExxonMobil and Chevron recorded record profits in Q2 as energy prices continued to push higher, boosted by the shortage that followed Russia’s invasion of Ukraine. UK-based Shell also reported record-breaking quarter earnings of $11.5bn on Thursday, whilst on the same day France’s TotalEnergies reported quarterly profits of $9.8bn, almost triple the same time a year ago.

Gold gained this week as cooling interest rate expectations and the potential of a weakening US economy pushed investors towards the precious metal.

The Week Ahead

Monday – EU Unemployment Rate

Tuesday – RBA Interest Rate Decision

Wednesday – EU Retail Sales

Thursday – BoE Interest Rate Decision, US Initial Jobless Claims

Friday – US Nonfarm Payrolls

*Price changes as of last week’s close unless stated otherwise.